Articles & Insights

Analysis and commentary on insurance regulation, AI, Open Insurance, SupTech, and EU digital finance — from the InsurTech4Good weekly newsletter.

18 February 2025

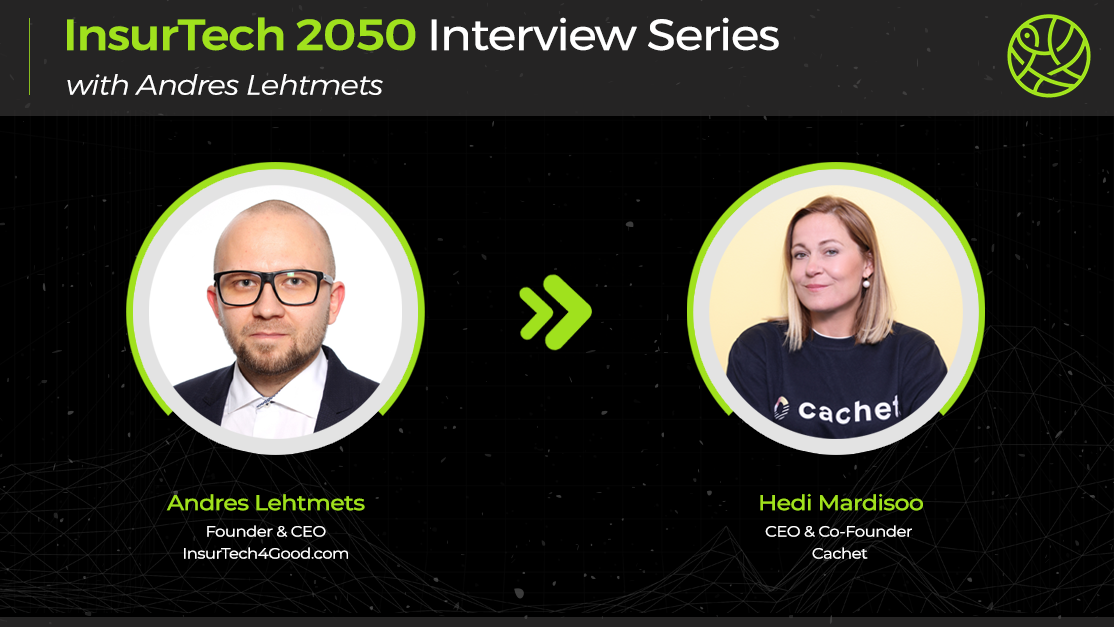

InsurTech 2050 | Hedi Mardisoo, Cachet

The goal of the InsurTech 2050 Interview Series is to create a platform where InsurTech founders, CEOs, and top insurance regulators and policymakers share their journeys and insights. This series aims to: * Inspire and support fellow founders and regulators/policymakers. * Foster closer collaboration and understanding between these two groups. * Provide thoughtful, in-depth discussions on the future of insurance and its biggest challenges. Today I´m speaking with Hedi Mardisoo from Cachet

17 February 2025

InsurTech4Good Weekly Newsletter – #7, 2025

This newsletter covers EIOPA’s consultation on AI governance and risk management, Gallagher Re’s 2024 InsurTech report on AI in claims, the European Commission’s 2025 work plan’s impact on insurance, and a new EU study on embedded supervision in decentralized finance, including insurance use cases.

17 February 2025

Embedded supervision of decentralized finance

The European Commission has just published a report presenting the outcome of a study undertaken by IBM Promontory for the Commission on embedding supervision in decentralized finance (DeFi). The project comprised four distinct phases: identifying use cases and protocols to assess, defining elements of comparison (benchmarks) with supervision in traditional finance (TradFi), developing a software application to collect data from the ledger, and analyzing the collected data to assess the potenti

17 February 2025

The European Commission's 2025 work plan and insurance

The European Commission's 2025 work plan has just been published, and for the insurance and financial sectors, the key takeaway is that the Financial Data Access (FiDA) proposal has been moved back under pending proposals compared to the leaked version! What does this mean? Regardless of whether you support or oppose FiDA, trilogues will most likely start now. If you still want to influence the negotiations, this is where you should focus your efforts. For background, every year, the Commissio

17 February 2025

EIOPA Consults on Its Opinion on Artificial Intelligence Governance and Risk Management

The EU insurance watchdog, EIOPA, is seeking feedback on its Opinion on Artificial Intelligence (AI) governance and risk management. The Opinion provides supervisors and insurance undertakings with guidance on how to interpret and implement insurance sector provisions in light of AI systems' use in insurance. It clarifies the key principles and requirements outlined in insurance sector legislation that should be considered when deploying AI systems. The Opinion applies to AI systems that are n

11 February 2025

InsurTech4Good Weekly Newsletter – #6, 2025

This week’s newsletter covers the potential withdrawal of the FiDA proposal by the European Commission, the EU AI Act requiring insurers to enhance AI literacy, new guidelines clarifying AI system definitions, the Digital Finance e-book on AI trends, and updated FAQs on the EU Data Act.

11 February 2025

Frequently Asked Questions about the Data Act

The EU Data Act sets horizontal rules on data access and use, ensuring fundamental rights protection and benefiting the European economy and society. It increases data availability, particularly industrial data, and promotes data-driven innovation. The Act also ensures a fair distribution of data value among all participants in the data economy. The Data Act will apply from 12 September 2025. The European Commission has now published updated Q&As on its implementation. Alongside the Data Go

11 February 2025

Digital Finance in the EU: Navigating New Technological Trends and the AI Revolution

This second EU Supervisory Digital Finance Academy (EU-SDFA) e-book provides an overview of key trends and topics relevant to the Academy. The EU-SDFA is a technical support project launched by the European Commission in October 2022, in cooperation with the European Supervisory Authorities (ESAs) and the Florence School of Banking and Finance (Robert Schuman Centre, EUI). The e-book is divided into two sections, comprising a total of nine contributions. The first section builds on last year’s

11 February 2025

AI Act AI system definition and insurance

The Commission published Guidelines on the definition of an AI system to facilitate the application of the first AI Act’s rules. This is also important for the insurance sector to better understand what falls within and outside the scope of the AI Act. The definition of an AI system entered into application on 2 February 2025, together with other provisions set out in Chapters I and II of the AI Act, notably Article 5 on prohibited AI practices. As the definition of an AI system is crucial for

11 February 2025

EU AI Act AI Literacy Practices in insurance

Introduction Under the EU AI Act, insurers and intermediaries that provide or deploy AI systems must ensure adequate AI literacy among staff and relevant stakeholders. This requirement is flexible to accommodate the diversity and complexity of AI tools. To support AI literacy, the European Commission has launched a Living Repository, an evolving collection of best practices. Among the contributors are Gjensidige and Generali, which share their AI use cases and training initiatives. Generali's

10 February 2025

European Commission's Annual Work Programme: FIDA Proposal to Be Withdrawn?

The European Commission will publish its Annual Work Programme tomorrow. This document informs the public and other institutions about the Commission’s political commitments, including plans to introduce new initiatives, withdraw pending proposals, and review existing EU legislation. According to a leaked version I have seen, the Financial Data Access (FIDA) proposal will be withdrawn. The stated reason is that it is not aligned with the Commission’s current objectives. The proposal would intro

5 February 2025

InsurTech 2050 | Mihkel Mandre, Lyfery

The goal of the InsurTech 2050 Interview Series is to create a platform where InsurTech founders, CEOs, and top insurance regulators and policymakers share their journeys and insights. This series aims to: * Inspire and support fellow founders and regulators/policymakers. * Foster closer collaboration and understanding between these two groups. * Provide thoughtful, in-depth discussions on the future of insurance and its biggest challenges. Today, I´m speaking with Mihkel Mandre from Lyfer