Articles & Insights

Analysis and commentary on insurance regulation, AI, Open Insurance, SupTech, and EU digital finance — from the InsurTech4Good weekly newsletter.

16 June 2025

InsurTech4Good.com Weekly Newsletter – #21, 2025

AI agents in finance | Open finance vs. open banking | FiDA privacy dashboards | FiDA & SIU | Skills gap and AI | AI sandboxes in the UK and Georgia | BlackRock’s insurance push

15 June 2025

Savings and Investment Union (SIU) and the Financial Data Access Regulation (FiDA)

Savings and Investment Union (SIU) and the Financial Data Access Regulation (FiDA)

28 May 2025

InsurTech4Good.com Weekly Newsletter – #20, 2025

AI & Consumer Trust | EIOPA GenAI Survey | AI in Finance | EU Data Strategy | EU Consumer Agenda | Music & Motor Insurance

12 May 2025

InsurTech4Good.com Weekly Newsletter – #19, 2025

FiDA & Open Insurance use cases | AI Liability Cover | AI Agents in Insurance | Global AI Regulation | InsurTech Funding Trends | Climate Resilience |

12 May 2025

Affirmative AI Liability Insurance

Armilla Insurance Services (Armilla), a Coverholder at Lloyd's, has announced the launch of its AI Liability Insurance policy. Underwritten by certain underwriters at Lloyd’s, including Chaucer, this policy provides affirmative coverage for AI-related risks. As stated in the press release, businesses are racing to deploy AI, but their risk management and insurance tools haven't kept pace. There is growing concern around “silent AI cover”—the uncertainty over whether existing policies will respo

11 May 2025

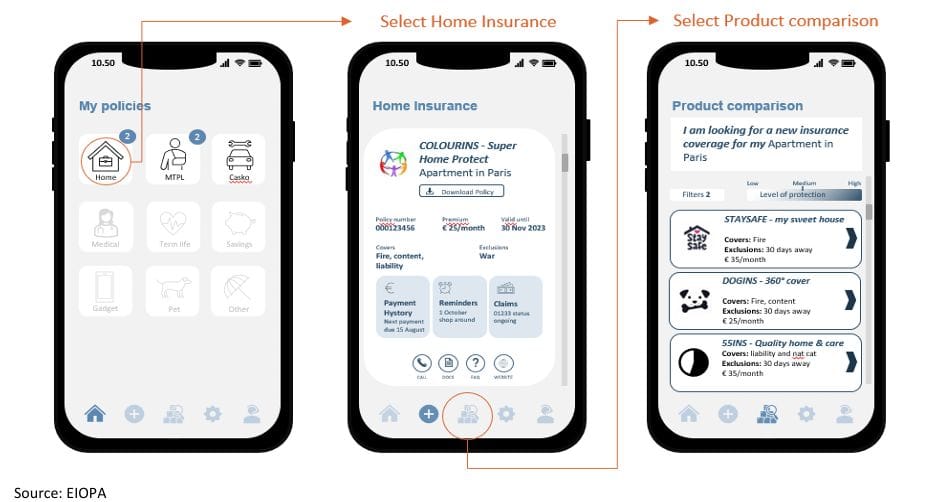

Open Insurance Use Case: Insurance Wallet

Why is it still impossible to get an overview of my insurance situation? Why do I always have to dig through my mailbox to find it? I’m not even talking about anything complex—just a simple overview: - These are my policies - These are my insurers - These are the renewal dates That is all (for beginning). I have several policies: home, rental apartments, life, casco, MTPL, MTPL for my hobby car, travel insurance and purchase insurance linked to different cards, a separate policy for my bic

11 May 2025

Open Insurance Use Case: Insurance Dashboard

Currently, consumers are unable to access a single, user-friendly overview of their existing insurance policies—but open insurance can change that. It is also difficult for consumers to compare their current policies with new offers during the purchasing process, making it harder to make informed decisions about switching or supplementing coverage. Open insurance can address that challenge as well. An insurance dashboard, built on open insurance or a broader open finance framework, could help

5 May 2025

InsurTech4Good.com Weekly Newsletter – #18, 2025

Insurance-specific LLMs | FCA’s AI live testing initiative | Insurance for development | Bank of England AI consortium | EIOPA risk dashboard

28 April 2025

InsurTech4Good Weekly Newsletter – #17, 2025

Financial Data Access | GenAI scaling in insurance | AI regulation strategy | Synthetic supervisory data | GenA.I. sandbox in Hong Kong

23 April 2025

Introduction to EU’s Financial Data Access (FiDA) proposal

If you operate in finance or insurance—and fall into one of the categories below—you cannot afford to ignore the EU’s Financial Data Access (FiDA) proposal. 1. Credit institution 2. Payment institution 3. Electronic money institution 4. Investment firm 5. Crypto-asset service provider 6. Issuer of asset-referenced tokens 7. Manager of alternative investment funds 8. Management company of undertakings for collective investment in transferable securities 9. Insurance undertaking

22 April 2025

InsurTech4Good.com Weekly Newsletter – #16, 2025

AI strategy for insurers | AI productivity in insurance and finance | Blockchain & GDPR compliance |

17 April 2025

InsurTech 2050 | Alain Aun, Rendin

The goal of the InsurTech 2050 Interview Series is to create a platform where InsurTech founders, CEOs, and top insurance regulators and policymakers share their journeys and insights. This series aims to: * Inspire and support fellow founders and regulators/policymakers. * Foster closer collaboration and understanding between these two groups. * Provide thoughtful, in-depth discussions on the future of insurance and its biggest challenges. Today I´m speaking with Alain Aun from Rendin. T